Balancing Company and Factor Risk- A Multipronged Approach

- Company Risk

- We define company risk not by statistical stock price variance constructs but by the probability of growth stock failure and the price paid for being wrong.

- We focus on the risk inherent in our defined risk buckets- some types of growth companies are ” just plain riskier” than most investors believe.

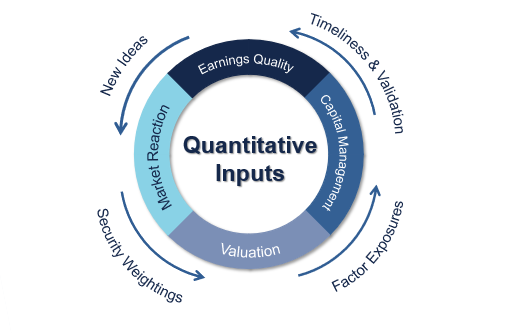

- We utilize numerous stock factor overlays to evaluate sources of stock price risk.

- Quality of earnings

- Excess capital management

- Valuation

- Investor/ market dynamics, behavioral biases

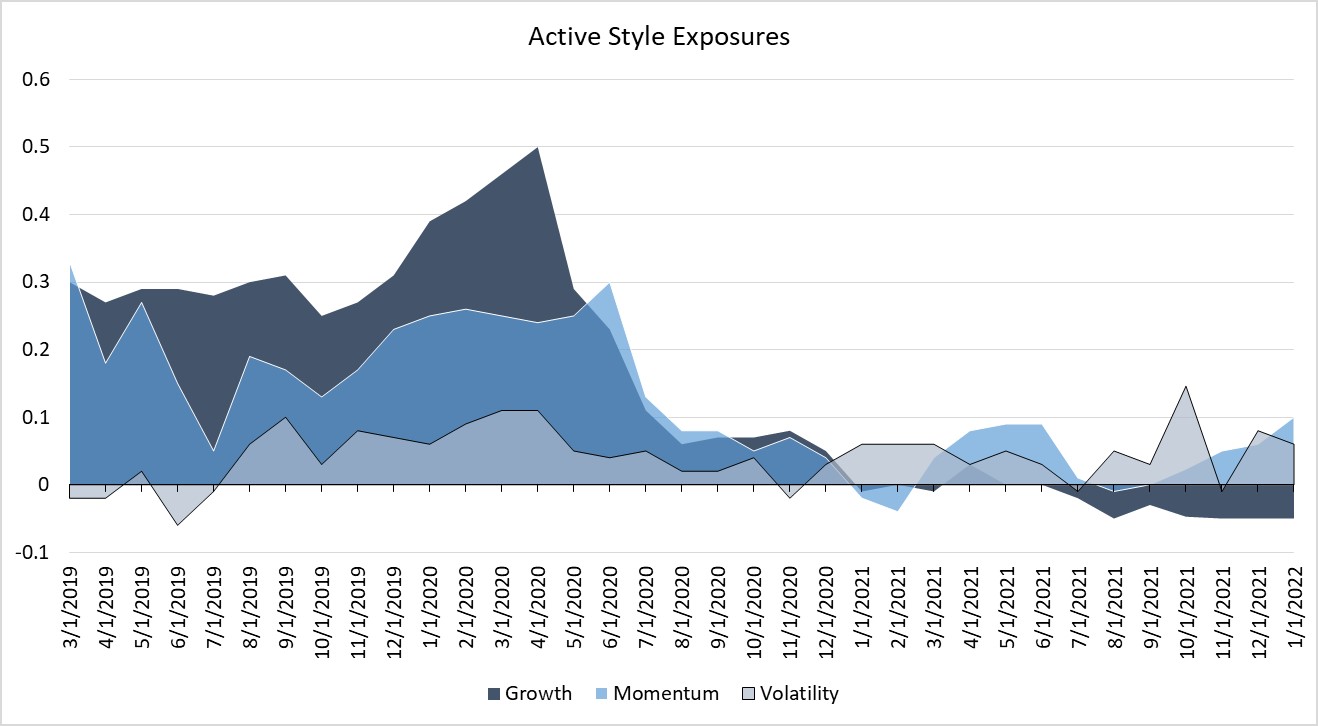

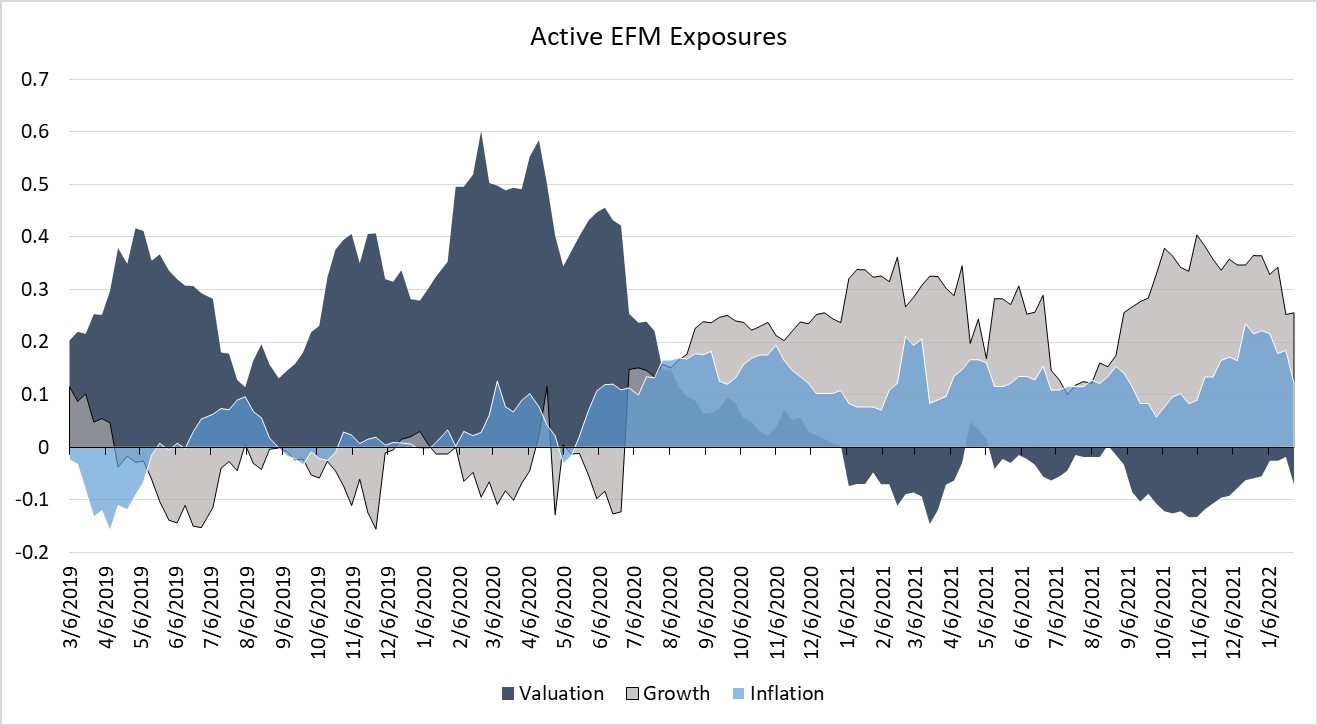

- Utilize our proprietary economic factor model to evaluate exposures to macroeconomic variables that can/might change leading to “unintended bets”.

- Inflation

- Excessive valuation expansion

- Economic growth expansion

Composite Performance as of June 30, 2024*

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

The Russell 1000 Growth Index represents a segment of the Russell 1000 Index that display signs of above average growth. The Russell 1000 Index is an index of approximately 1,000 of the largest companies in the U.S. equity markets.

Composite Performance reflects reinvestment of all income and capital gains and is shown in US dollars and after the deduction of transaction costs. Composite Performance is shown gross and net of actual management fees charged. Actual investment advisory fees incurred by clients may vary. Additional information on the calculation methodologies used herein is available upon request. Indexes are unmanaged, do not incur management fees and cannot be invested in directly. The Composite and index returns are net of any foreign withholding taxes on dividends, interest, and capital gains.

Past performance is not indicative of future results. Performance during certain periods reflect strong stock market performance that is not typical and may not be repeated.